The insurance-based health care model has been the main currency of the health care industry in the US for the longest time. However, in recent years, Direct Primary Care and Concierge Medicine has evolved as one of the best alternatives to insurance-based health care.

Concierge medicine is an emerging membership-based health care model wherein patients can receive enhanced access and more personalized direct medical care from their concierge doctors. While the membership fee covers these enhanced services, many concierge practices still work with insurance companies for other covered medical services.

1. Doctor-Patient Relationship: A major differentiator between Concierge Medicine and insurance is the connection that patients can establish with their physicians. In Concierge Medicine, you subscribe to a particular primary care physician, and you are welcome to get in touch with them whenever needed.

With health insurance, you do not have the privilege to get close to your primary care physician for several reasons:

2. Cost: In terms of monthly premiums and subscription fees, the comparison is multifaceted. Concierge Medicine subscriptions range around $125-$250 per month on average (equating to roughly $1,500-$3,000+ annually, with variations based on services and location, and discounts sometimes available for family subscribers), while the average annual employer-sponsored insurance premium costs around $8,951 for an individual and $25,572 for a family as of 2024.

Compared with Concierge Medicine, the monthly insurance premiums can go higher or lower depending on certain factors, such as your age, employer, tobacco use, etc., whereas the subscription fee is generally more fixed, though it can vary by service tier or age group in some practices.

3. Service Inclusions: Concierge Medicine subscriptions usually cover premium primary care services, enhanced access, and personalized wellness planning. In contrast, insurance covers a comprehensive range of "essential health benefits" such as emergency services, hospitalization.

It also includes laboratory tests and procedures, maternity and newborn care, out-patient care, prescription drugs, and more. The more comprehensive your Insurance plan is, the more expensive it becomes.

Concierge medicine subscription does not replace your insurance plan, the priceless benefits you get out of concierge medicine truly outweigh the cost.

Concierge Medicine and Insurance have a glaring difference because Concierge Medicine is more transparent and straightforward with their services covered by the membership fee. On the other hand, health insurance plans have complicated clauses and conditions to keep track of carefully.

For instance, certain procedures come for free within your plan if you are above 50 years old. However, if you are below 50 years of age and you avail of the service, you will have to pay for the said procedure and a copay fee for when you consult your physician.

4. Payment terms: In comparison with Concierge Medicine and insurance, payment terms are specifics you should take into consideration. Apart from monthly premiums, patients who avail of insurance also have to factor in deductibles, copay fees, and other out-of-pocket expenses in the equation.

Below average patient care in exchange for exorbitantly expensive medical fees are a major pain point in the traditional, insurance-based model – and this is what has driven Concierge Medicine into the spotlight.

Depending on the scope of services and payment terms you wish to avail, the Concierge Medicine subscription fees range from typically $125 to a few hundred dollars per month, with some very high-end practices charging significantly more.

5. Benefits and Perks: When it comes to the quality of service each option provides, this is where Concierge Medicine is a unanimous winner. Patients get 24/7 unrestricted access to their primary physician, heavily discounted out-patient services and medication, and highly individualized, proactive patient care are few of the concierge medicine benefits patients gets for a monthly subscription fee. While some concierge practices may offer access to discounted ancillary services or medications, this is a more prominent feature of Direct Primary Care (DPC) models.

Apart from its comprehensiveness, there is not much insurance plan brings to the table in terms of seamless service, quality patient care, and affordable health care costs.

In fact, in the argument between Concierge Medicine vs. Insurance, the insurance based model is notorious for rushed, robotic appointments, unexpected medical charges, and frustrating booking procedures.

The key to finding the right balance between Concierge Medicine vs. Insurance is to bank on each health care model's strengths. As concierge medicine subscription does not replace your insurance plan, they must co-exist somehow.

The way concierge doctors interact with insurance varies. Many concierge practices do accept and bill health insurance (including Medicare) for covered medical services that are separate from the membership fee.

Others may operate on a "fee-for-service" basis for these non-membership services, or assist patients with out-of-network claims.

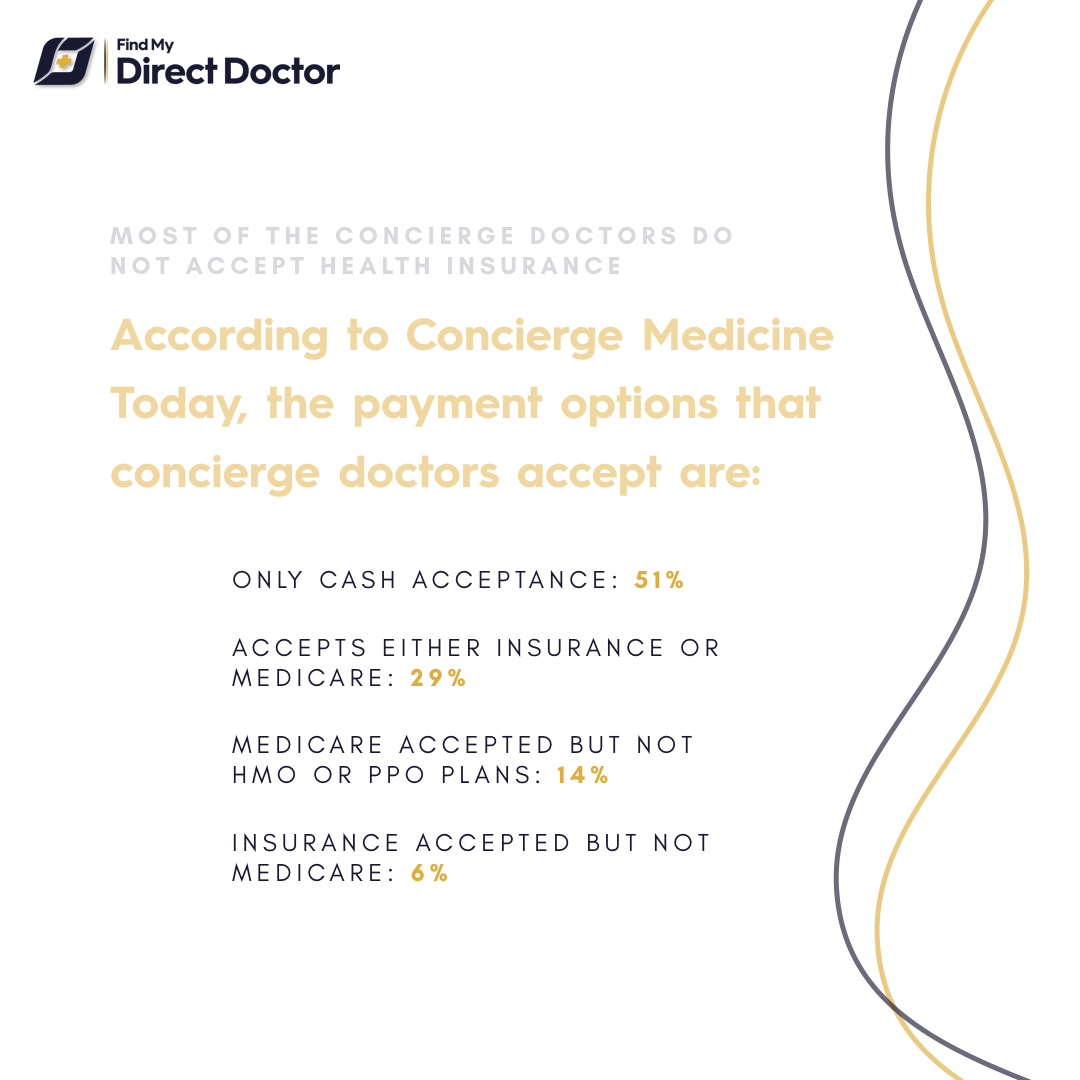

According to conciergemedicinetoday.org, in past surveys, the payment options that concierge doctors accept have shown varied models, including practices that bill insurance and/or Medicare, and others that operate on a cash-only basis for services beyond the membership. It is essential for patients to clarify this with individual practices.

Your Concierge Medicine subscription is designed to extend top-caliber patient care, which only follows that it is best to leave primary and routine care to those you can rely on and trust.

Primary care is crucial to keeping debilitating illnesses, ER trips, and hospital confinements at bay, and your concierge doctor is in the best position to keep you in the pink of health.

On the other hand, because your Concierge Medicine subscription already covers enhanced access and many aspects of primary/routine care, you can reduce your insurance plan to a more affordable one that covers catastrophic illnesses, hospitalization expenses, and subspecialty services only.

Join the movement for improved patient-centred care and see a concierge doctor in your area today. Find your nearest concierge doctor at – findmydirectdoctor.com