Concierge medicine is an emerging and trending model in the American health care system, which has evolved as one of the best alternatives to insurance-based health care. Nowadays, people are choosing these membership-based models over insurance-based traditional health care models.

While some concierge medicine practices may operate on a cash-only basis, many do accept and bill health insurance for covered medical services, functioning similarly to traditional practices in this regard. The good news is Concierge Medicine and Health Savings Account (HSA) can work well together for eligible expenses.

If you have a Health Savings Account (HSA) plan, knowing your way around Concierge Medicine can lower your healthcare costs.

Providers mostly accept cash or credit cards, and HSA serves as a smart and viable alternative to get coverage for qualified medical expenses.

Concierge medicine takes us back in time when healthcare was better and more accessible – like how it was in the '60s when doctors came to your house to treat you. This is just one of the many benefits of having a Concierge Medicine membership.

Instead of a fee-for-service agreement employed under the insurance-based model, your provider charges you a membership fee, which can vary widely but often ranges from approximately $2,000 to $5,000 per year, though it can be higher in major markets or for more extensive services .

This fee is in exchange for a series of services under the concierge agreement. Some of the most common services include extended and same-day appointments, 24/7 access to the personal line of your provider, and more.

And the result of all the perks granted under concierge medicine? Convenience in accessing healthcare, precision in determining medical issues, and a closer doctor-patient relationship.

A Health Savings Account (HSA) is an account that gives you more control over your healthcare spending. You can get one by having a high-deductible health plan (HDHP) that charges a lower premium but has a higher deductible.

A higher deductible initially sounds unattractive because it means that you will have to pay more out of pocket, but that is the whole purpose of your HSA. It lets you put aside money specifically for medical expenses that you can use should you need it. As a tax-advantaged account, the government does not tax anything you put into it, including any interest you earn.

But what makes it great is your contribution here (for 2024, the maximum contribution is $4,150 for self-only HDHP coverage and $8,300 for family HDHP coverage; for 2025, these limits increase to $4,300 and $8,550, respectively, with an additional $1,000 catch-up contribution allowed for those age 55 and older ) comes from your untaxed income. So if you are in the 24% tax bracket, you are essentially saving a significant amount on your taxes just by setting aside money in your HSA.

If you are unsure whether your HSA will cover a medical expense, remember this general rule: eligibility for HSA funds is determined by whether the expense qualifies as "medical care" under Section 213(d) of the Internal Revenue Code, which includes costs for diagnosis, cure, mitigation, treatment, or prevention of disease. It is not based on whether insurance normally pays for it.

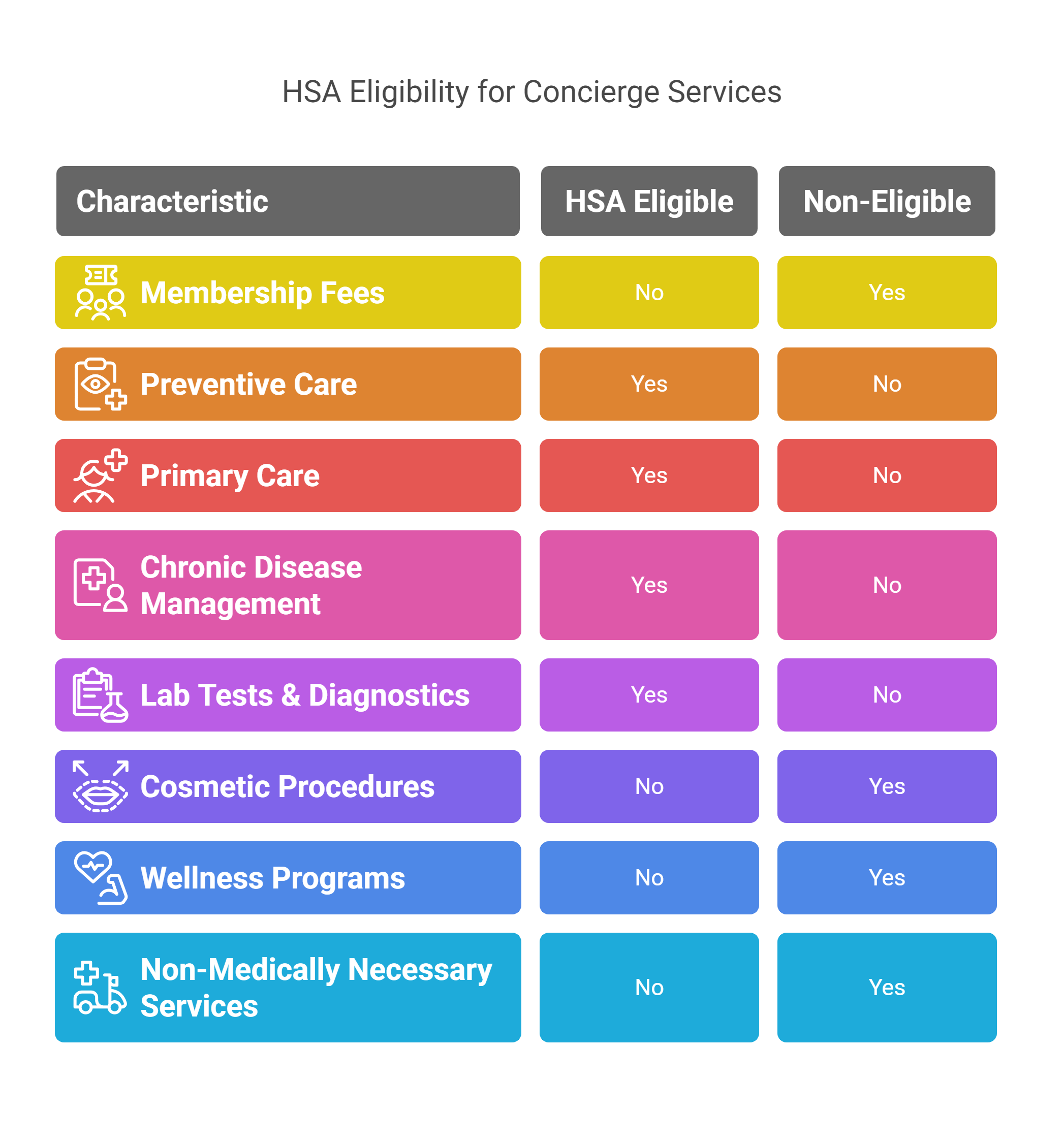

Following this IRS guidance, your Health Savings Account generally cannot pay for your concierge medicine membership fees if those fees are solely for access or availability, as these are typically not considered qualified medical expenses . But you can still use it for specific, itemized qualified medical services your concierge doctor offers. You can:

In any case, make sure to get an itemized bill from your doctor. Detailed records would come very useful should the IRS audit you.

Although you cannot directly use your HSA to cover your entire membership fee if it includes non-medical access fees, there may be a way for you to use HSA funds for the qualified medical care components.

Normally, this fee includes a range of services, some of which may be actual medical care already paid for under the concierge agreement. And as you no longer have to pay separately at the time of service for these specific medical services, it opens an opportunity for reimbursement if they are qualified medical expenses and properly itemized.

If your doctor is willing to provide an itemized invoice that clearly separates the cost of specific qualified medical services from any general access or retainer fee, you can reimburse yourself through your HSA for those specific service costs. Perhaps it will not cover the full amount of the membership fee, but it will help reduce your out-of-pocket expense for actual medical care received.

Better yet, ask your concierge doctor which services under the agreement are potentially qualified medical expenses eligible for HSA reimbursement and how they will be itemized. This will give you a better sense of your medical expenses under concierge medicine.

Concierge medicine and Health Savings Account (HSA) are both revolutionary solutions. They work well together in managing your medical costs for eligible services while also improving the healthcare quality you receive.

Now how to choose a concierge doctor? Making exceptional healthcare accessible to patients like you is our ultimate goal. Enjoy the best that healthcare has to offer, and find a concierge doctor in your area.

Purely access or retainer-based membership fees in Concierge Medicine are generally not covered by your Health Savings Account (HSA) as they are typically not considered qualified medical expenses by the IRS . However, if your concierge practice provides specific, itemized medical services that meet the IRS definition of medical care, those specific service costs may be reimbursable via your HSA.

The rule of thumb here is this: an expense is HSA-eligible if it meets the IRS definition of "medical care" under Section 213(d) of the Internal Revenue Code. This means that, although your HSA generally cannot cover your Concierge membership fees if they are for access only, there are particular qualified medical services within your membership (if itemized separately) which can be reimbursed using your HSA.

Although your HSA generally cannot cover your Concierge Medicine membership fee if it's solely for access , what you can do is to simply pull funds from your HSA and pay your Concierge doctor directly for specific, itemized qualified medical services rendered. No need to worry about getting taxed – this is accepted because fees for actual medical care from a physician are considered a qualified medical expense.

There are ways you can utilize your HSA to pay for specific, itemized qualified medical services within your Concierge Medicine arrangement, even though your purely access-based membership or subscription fee is generally not an eligible expense under your HSA. Make sure to check which Concierge services are qualified medical expenses and always ask your doctor for an itemized invoice so that processing your reimbursements are a breeze.

Concierge membership fees that are solely for access or availability are generally not HSA eligible , although fees for specific, qualified medical services rendered by a doctor are HSA reimbursable. A way to properly use HSA funds is to go over the list of medical services included in your membership and see which ones are itemized as qualified medical expenses eligible for HSA payment or reimbursement.

While your entire Concierge membership fee (if it includes charges for access/availability) generally cannot be covered by HSA, there are specific qualified medical services within your Concierge arrangement which, if itemized, may be HSA reimbursable. This can still merit you significant medical savings so taking time to do your research on IRS rules for qualified medical expenses is very important.

No, you generally cannot use your HSA to cover medical membership fees in Direct Primary Care and Concierge Medicine subscriptions if these fees are solely for access or availability rather than for specific medical services rendered . On the other hand, there are specific medical services provided under your membership which can be reimbursed through your HSA if they are qualified medical expenses and properly itemized.

Purely access-based Concierge fees are generally not HSA eligible, but there are certain charges within your Concierge subscription which are qualified for HSA reimbursement – fees for specific, itemized qualified medical services rendered by a doctor are one of them.